capital gains tax philippines

CGT is a tax on the gain from the sale of capital assets. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions.

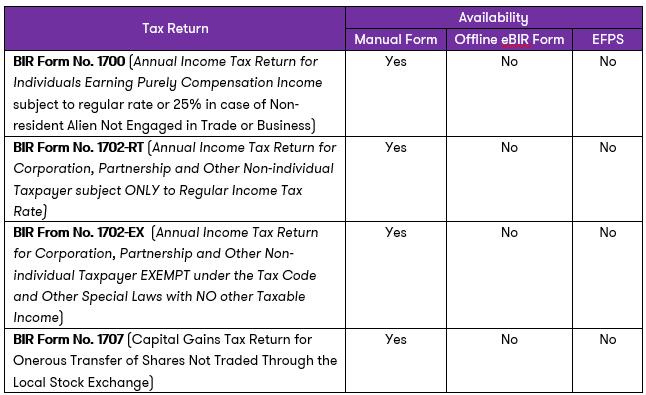

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

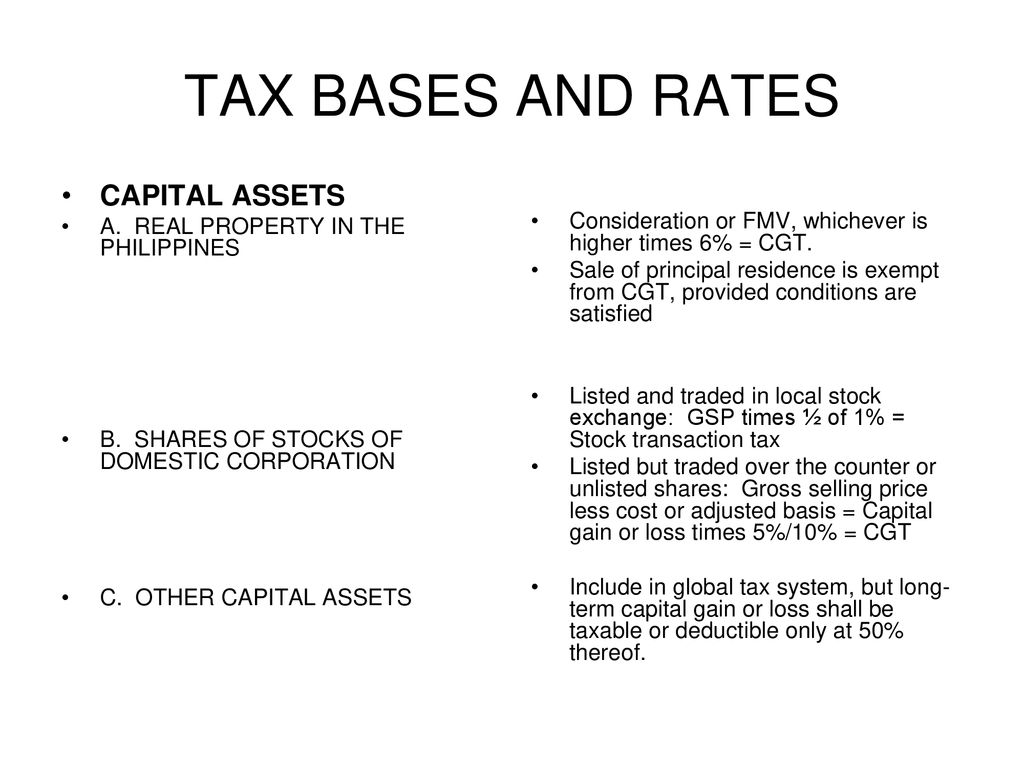

- The provisions of Section 39 B notwithstanding a final tax of six percent 6 based on the gross selling price or current fair market value as determined in 24 accordance with Section 6 E of this Code whichever is higher is hereby imposed upon capital gains presumed to have been realized.

. Lt is not the transfer of ownership or possession per se that subjects the saletransferexchange of the 6 capital gains tax but the profit or gain that was presumed to have been realized by the seller by means of said transfer. In computing the capital gains tax you simply determine the higher value of the character and simply multiply the same with 6. Capital gains tax CGT is imposed on both domestic and foreign sellers.

The Philippines is strategically located off the southeastern coast of mainland Asia with a flying time of four hours or less to most major Asian countries. Capital gains tax on sale of real character located in the Philippines and held as capital asses is based on the presumed gains. The following capital gains are not subject to a holding period and are subject to special capital gains tax rates.

To calculate the capital gains tax you check the value of the property or its current fair market value whichever is higher and multiply that by 6. PENALTIES FOR LATE FILING OF TAX RETURNS. Capital Gains Tax is imposed on gain that the seller gets from a sale exchange or other transfer of capital assets that are located in the Philippines.

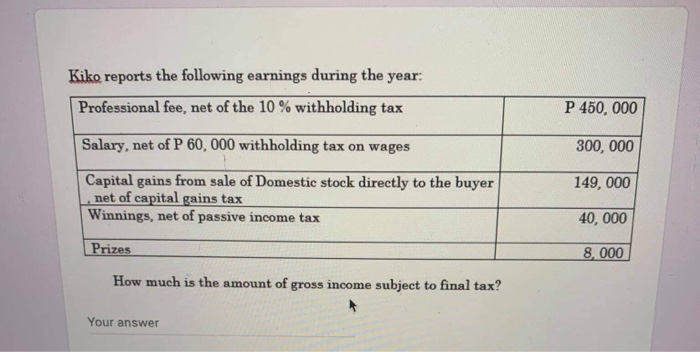

Net capital gain is the difference between the selling price and the FMV of the shares whichever is higher less the shares cost basis plus any selling expenses. This is not necessarily the case. A There shall be imposed in addition to the tax required to be paid a penalty equivalent to twenty-five percent 25 of the amount due in the.

After you get the net estate multiply the resulting amount by 006. In computing the capital gains tax you simply determine the higher value of the property and simply multiply the same with 6. If held for more than 12 months only 50 percent of the gain is subject to tax.

The amount that youll get from this computation will be the estate tax. Documentary Stamp Tax Philippines. Capital gains tax on sale of real property located in the Philippines and held as capital asses is based on the presumed gains.

Pacto de retro sales and other forms of conditional sales are included in this. Capital gains realized from the sale exchange or disposition of shares of stock in any domestic corporation are subject to a final tax rate of 15. Philippine Tax Classifications and Cryptocurrency Income Tax.

When there is a sale of real estate automatically people think that they have to pay Capital Gains Tax CGT. Now that you know the difference between gross estate and net estate its time to compute the estate tax. Capital Gains Tax is charged at a flat tax rate of 6 of the gross selling price and must be paid within 30 days after each transaction.

According to the Philippine Tax Code Capital Gains Tax is a tax that is imposed on earnings that the seller has gained from the sale of capital assets. For example if the property is valued at Php 1000000 you multiply that by 6 and the total sum of capital gains tax the seller pays is Php 60000. The Philippine Tax Code grants the Commissioner of Internal Revenue the power to reallocate income and.

Computing the Estate Tax. Capital gains taxes. The property is directly and jointly owned by husband and wife.

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines including pacto de retro sales and other forms of conditional sale. Capital Gains Tax vs. What is a Capital Asset.

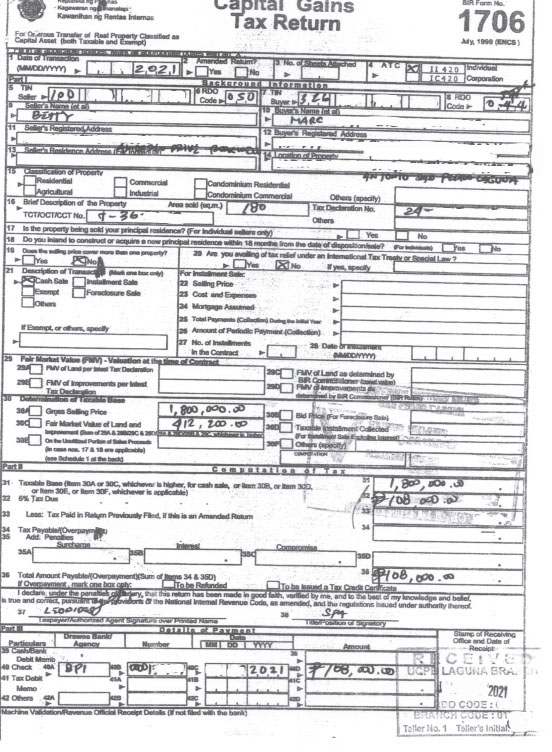

D Capital Gains from Sale of Real Property. What is Capital Gains Tax in the Philippines. The rate is 6 capital gains tax based on the higher amount between the gross selling price or fair market value.

The rate is 6 capital gains tax based on the higher amount between the gross selling price or fair market value. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due. Its strategic location allowed it to bridge Eastern and Western cultures producing a rich history of Asian European and American influences.

Last reviewed - 31 December 2021. 1 In General. Php 1000000 x 6 Php 60000.

The payment of the capital gains tax is dependent and is a direct consequence of the sale transfer or exchange. This includes capital gains from the sale of real estate property located in the Philippines classified as capital assets by individuals. The property was worth US250000 or 250000 at purchase.

A capital gains tax may be imposed if and only if the Securities and Exchange Commission classifies certain cryptocurrencies as securities or something that has speculative value. According to Section 24D capital gains from the sale of real estate properties in the Philippines have a capital gains tax of 6 percent which is based on the gross selling price or current fair market valuewhichever one is higher of the two. And so should the government treat cryptocurrencies similar to stocks then it.

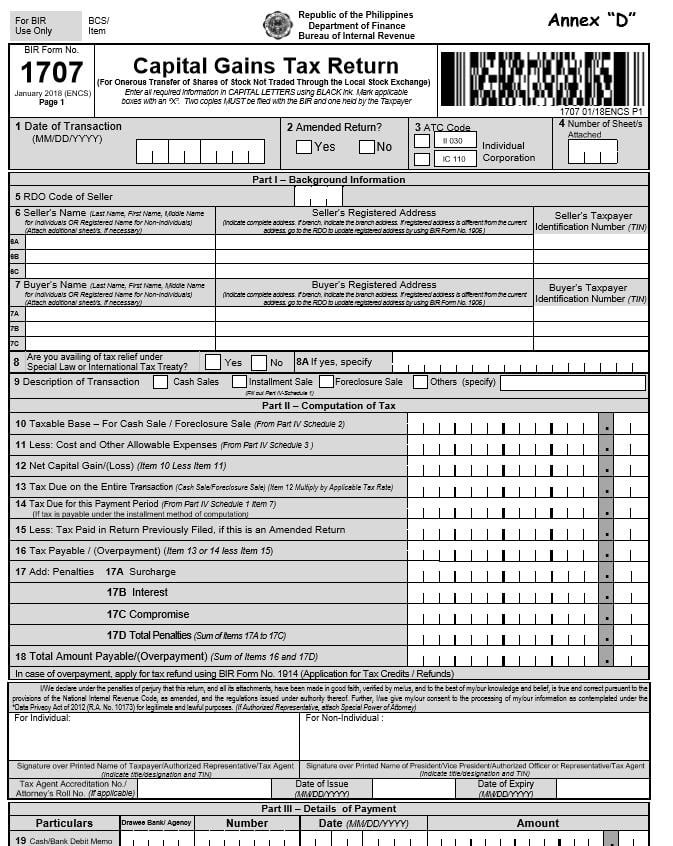

Estate tax in the Philippines is 6 of the net estate. Final Capital Gains Tax for Onerous Transfer of Real Property Classified as Capital Assets Taxable and Exempted.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

How To Compute Capital Gains Tax Train Law Youtube

What S Your Tax Rate For Crypto Capital Gains

Buying Property In The Philippines Youtube

Solved Ms Abc A Resident American Had The Following Chegg Com

Capital Gains On Selling Property In Orlando Fl

Train Series Part 4 Amendments To Withholding Tax Regulations Zico Law

Taxes And Title Transfer Process Of Real Estate Properties This 2021

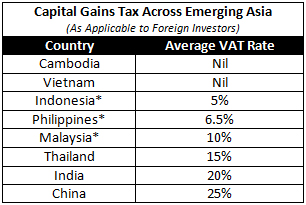

Capital Gains Tax China Briefing News

How To Compute Capital Gains Tax On Sale Of Real Property Business Tips Philippines

How To Compute File And Pay Capital Gains Tax In The Philippines An Ultimate Guide Filipiknow

Income And Withholding Taxes Ppt Download

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

Capital Gains Yield Cgy Formula Calculation Example And Guide

What S Your Tax Rate For Crypto Capital Gains

Ordinary Asset Versus Capital Asset Robert G Sarmiento Robert G Sarmiento